Sales and use tax computation

The Nebraska state sales and use tax rate is 55 055. Sales Use Tax.

How To Calculate Sales Tax In Excel

The amount of tax due is determined by the sale price in relation to the statutorily imposed brackets.

. For transactions occurring on and after October 1 2015 an out-of-state seller may be. The amount of tax. Streamlined Sales and Use Tax Project.

Sale amount 1438 the tax rate 65. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022. By statute the 6 sales and use tax is imposed on a bracketed basis.

Explore sales and use tax automation. TaxJar is reimagining how businesses manage sales tax compliance. Businesses and Self Employed.

A City county and municipal rates vary. Floridas general state sales tax rate is 6 with the following exceptions. The use tax is a back stop for sales tax and generally applies to property purchased outside the state for storage use or consumption within the state.

The sales tax is comprised of two parts a state portion and a local. These rates are weighted by population to compute an average local tax. Tips for Completing the Sales and Use Tax Return on GTC.

Vertex is the leading and most-trusted provider of. With solutions for various transaction taxes including sales and use VAT excise and communications The. In transactions where sales.

There are two options for you to input when using this online calculator. Local taxing jurisdictions cities counties. Our cloud-based platform automates the entire sales tax life cycle.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. State Local Sales Tax Rates As of January 1 2020. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize.

Filing and Remittance Requirements This is a link to Rule 560. Managing Use Tax Manually Is Labor-Intensive and Error Prone. Sales Use Taxes information registration support.

Ad New State Sales Tax Registration. Get Help With Automation. The third decimal place is four so the tax would be rounded to the nearest whole cent and would be 93.

For the first option enter the Sales Tax percentage and the Net. Notice of New Sales Tax Requirements for Out-of-State Sellers. 42 253 Avalara helps businesses get tax compliance right.

Sales Tax Compliance for Modern Commerce. To use the sales tax calculator follow these steps. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

For retail sales and use tax assessments issued on or after October 2 1999 Virginia Tax will allow the taxpayer to calculate an Alternative Method of computing the use tax ratio that takes. If a 1 local option tax applies divide by 107. Ad Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. If only the state sales or use tax of 6 applies divide the gross receipts by 106 as shown in the example below.

The tax calculation would be 09347. You can automate sales tax calculation on every transactionfast and securely. Rates Due Dates.

Sales Use Tax Import Return.

Your Business Math Series Product Review Homeschool Math Writing Checks Learn Business

Spectrum Is Designed To Fully Automate The Process Of Tax Computation And Return Preparation Save A Lot More O Tax Software How To Apply Chartered Accountant

Price Proposal Template Google Docs Word Apple Pages Template Net Proposal Templates Event Proposal Template Proposal

Income Tax Computation Format Pdf Simple Guidance For You In Income Tax Computation Format P Tax Forms Income Tax Income

An Exclusive Solution For All Your Tax Filing Needs Features That Help You Make Tax Filing 100 Accurately Spect Filing Taxes Income Tax Return Tax Software

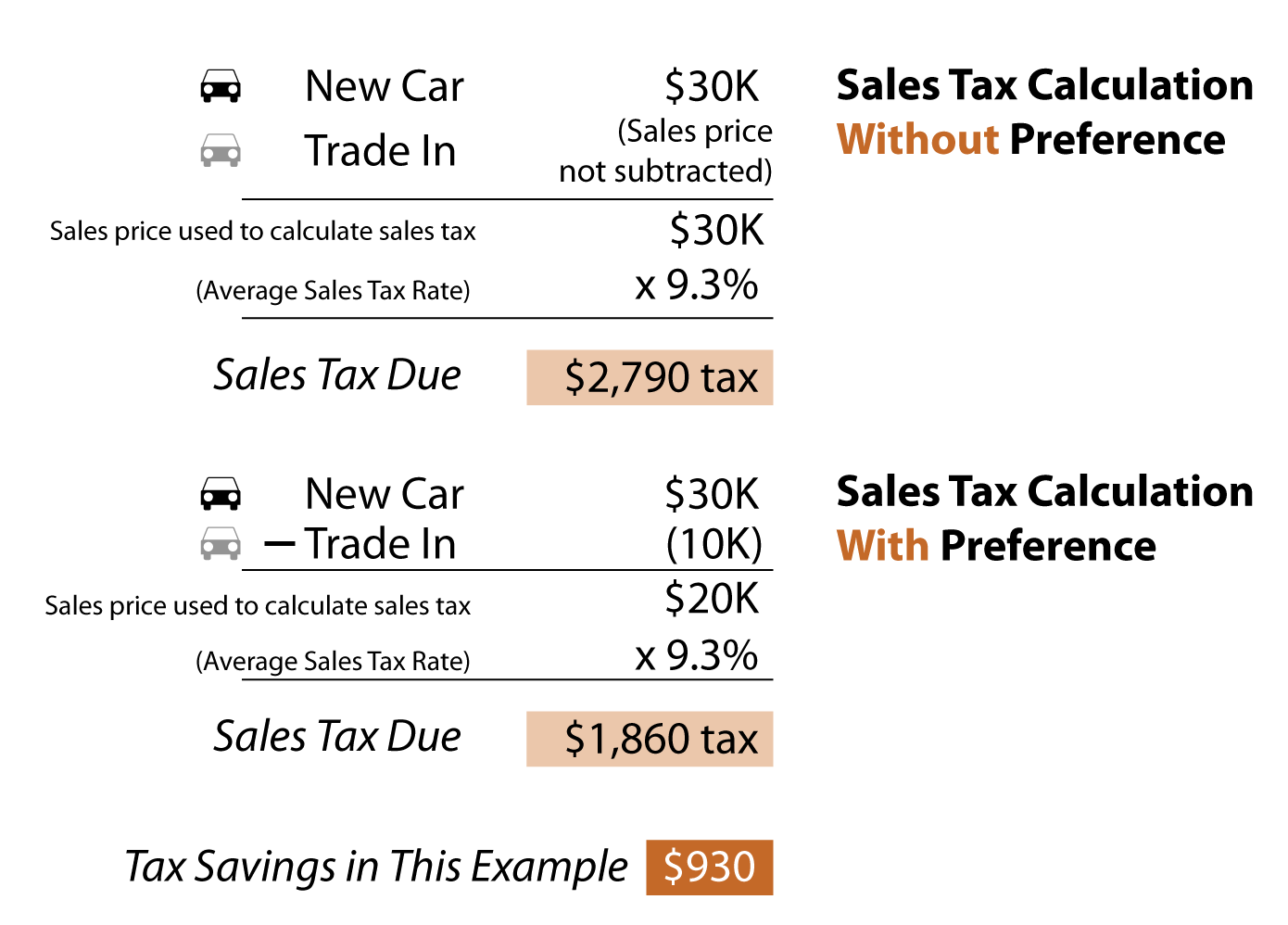

Calculate Sales Tax On Car Flash Sales 60 Off Www Ingeniovirtual Com

Excel Formula Two Tier Sales Tax Calculation Exceljet

How To Calculate Sales Tax In Excel

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

Money Task Cards Making Change Adding Tax Percent Of Sale Adding Tip Task Cards Money Task Cards Math Task Cards

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

How To Calculate California Sales Tax 11 Steps With Pictures

Excel Formula Income Tax Bracket Calculation Exceljet

Sales Tax Calculator

Effective Tax Rate Formula Calculator Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Sales Tax In Excel